Sure Ventures plc (‘Sure Ventures’ or ‘the Company’)

31 July 2019

Final Results

Sure Ventures plc, a venture capital fund which invests in early stage software companies in the rapidly growing tech verticals of augmented reality (‘AR’), virtual reality (‘VR’), and Internet of Things (‘IoT’) and Artificial Intelligence (AI) in fintech sectors, is pleased to announce its annual results for the first full year investment for the year ending 31 March 2019.

The Company’s annual report and audited financial statements will be posted to shareholders shortly and will be made available on the Company’s website www.sureventuresplc.com.

Overview

· Advanced strategy of generating shareholder value through investing in early stage technology companies in the rapidly growing sectors of AR/VR, AI, IoT and FinTech

· Directly invested in Immotion Plc

· Directly invested in VividQ Ltd, a UK-based deep technology software company pioneering the application of holography in AR/VR and consumer electronic display

· Maintained 22.17% interest in the Sure Valley Ventures subfund providing exposure to a diverse, balanced portfolio of ten early stage technology companies including VR Education, listed on the London Stock Exchange

· Appointment of Perry Wilson as Chairman and Non-Executive Director and St. John Agnew as Non-Executive Director further enhancing the Company’s well developed network

Chairman’s Statement

Dear Shareholders,

On behalf of my fellow directors, I am delighted to present the annual results for Sure Ventures plc (the “Company”) for the first full year investment for the year ending 31 March 2019.

Financial Performance

In the year to 31 March 2019 the Company’s performance was broadly in line with expectations, returning a net asset value of -9.87%, which can be explained largely by the fall in share prices of the two listed portfolio investments, Immotion plc and VR Education Holdings plc. Immotion plc is a directly held investment that has subsequently recovered since 31 March 2019 year end price (5.125p) and is now trading close to its IPO issue price (currently 9.40p). VR Education is held through the Company’s investment in the Sure Valley Ventures sub fund of Sure Valley Funds ICAV (the “Fund’), being the only listed investment held in the Fund’s portfolio and it continues to trade around its year end closing price (currently 9.00p).

The investee companies within the Fund’s portfolio, in which the Company maintains an interest of 22.17%, have grown throughout the year and now stand at ten across a diverse, balanced range of early stage software ventures in the augmented reality (AR), virtual reality (VR), internet of things (IoT), financial technology (FinTech) and artificial intelligence (AI) space.

The Company’s share price continues to trade at a premium in excess of 20% of the last published net asset value, which we believe supports the growth potential of the Company’s investments and demonstrates an understanding among shareholders of the Company’s investment rationale and investment horizon.

Portfolio Update

In the year to 31 March 2019 Sure Valley added investments in five early stage technology companies, to complement the portfolio of investments in five companies held as at 31 March 2018. Of these ten companies, nine remain privately owned with each investment being held at the initial seed investment valuation, with the exception of WarDucks which successfully raised €3.3m in March 2019 in a Series A funding round led by EQT Ventures leading to a x4 uplift in valuation of the original investment.

In addition to the existing direct investment in Immotion plc, a second direct investment by the Company of £500,000 was announced in April 2019 in Vivid Q Limited, a Cambridge, UK-based deep technology software company pioneering the application of holography in AR/VR and consumer electronics display.

Further detail is provided in the Investment Manager’s Report and the Business Review which follows this statement.

Dividend

During the Period to 31 March 2019, the Company has not declared a dividend (31 March 2018 – £nil). Pursuant to the Company’s dividend policy the directors intend to manage the Company’s affairs to achieve shareholder returns through capital growth rather than income. The Company does not expect to receive a material amount of dividends or other income from its direct or indirect investments. During the year ended 31 March 2019, it should not be expected that the Company will pay a significant annual dividend, if any.

Gearing

The Company may deploy gearing of up to 20% of net asset value (calculated at the time of borrowing) to seek to enhance returns and for the purposes of capital flexibility and efficient portfolio management. The Company’s gearing is expected to primarily comprise bank borrowings,but may include the use of derivative instruments and such other methods as the board may determine. During the period to 31 March 2019 the Company did not employ any borrowing (31 March 2018 – £nil).

The board will continue to review the Company’s borrowing, in conjunction with the Company’s Investment Manager on a regular basis pursuant with the Company’s overall cash management and investment strategy.

Outlook

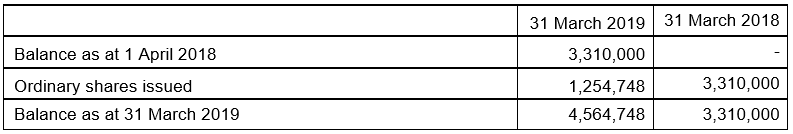

In the year to 31 March 2019 the Company raised additional gross proceeds of £1,278,480, bringing the total ordinary shares in issuance as at the year end to 4,564,748. On 7 June 2019 the Company announced a raising of further gross proceeds of £293,000 by way of a private placement and following this latest admission, the Company has 4,808,026 ordinary shares in issue.

The Investment Manager’s Report and Business Review following this Statement give further detail on the affairs of the Company. The board is confident of the long-term prospects for the Company in pursuit of its investment objective and believes that the robust deal pipeline will result in additional transactions that will complement the Company’s existing investments.

Board

I am very pleased to have been appointed Chairman and Non-Executive Director of the Company in December 2018 and in the short period of my engagement the Company has continued to identify new, exciting and innovative investment opportunities through its well-developed network. Furthermore, we welcome St. John Agnew as a Non-Executive Director to the board who replaced Chris Boody on 14 June 2019 due to Mr Boody’s ongoing commitments to a global technology business. Mr Agnew brings a wealth of experience in investment management, is a lawyer by training and has served in other Non-Executive and trustee roles. Gareth Burchell continues in his role as a Non-Executive Director of the Company, which he has held since the Company’s inception.

Perry Wilson

Chairman

24 July 2019

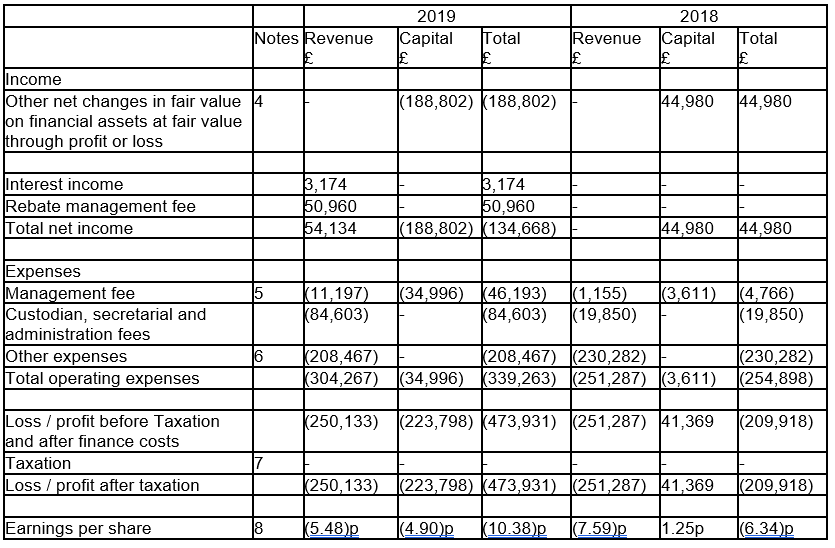

Statement of Comprehensive Income

For the year ended 31 March 2019

The total column of this statement represents the Statement of comprehensive income prepared in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union. The supplementary revenue return and capital return columns are both prepared under guidance issued by the Association of Investment Companies. All items in the above statement derive from continuing operations.

The Company does not have any income or expense that is not included in net loss for the year. Accordingly, the net loss for the year is also the Total Comprehensive Income for the year, as defined in IAS1 (revised).

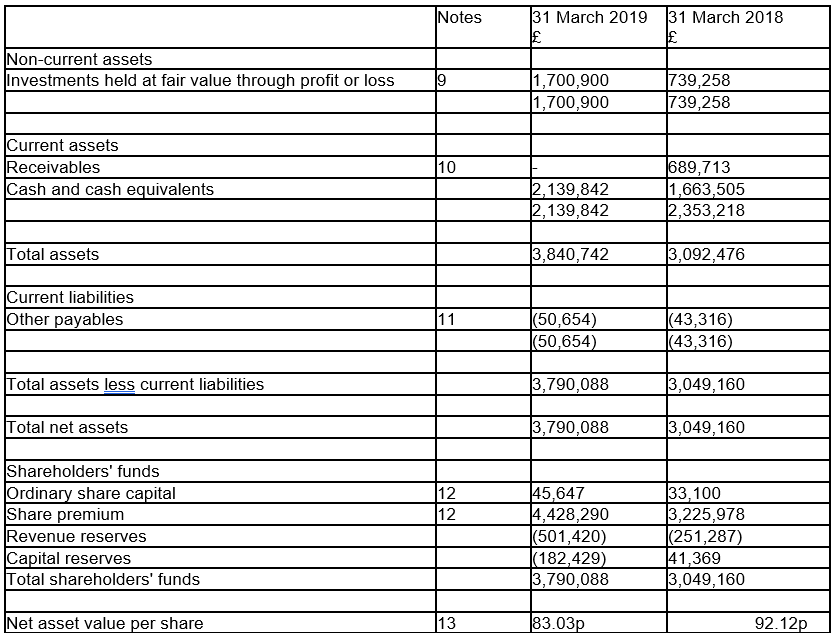

Statement of Financial Position

As at 31 March 2019 Company No. 10829500

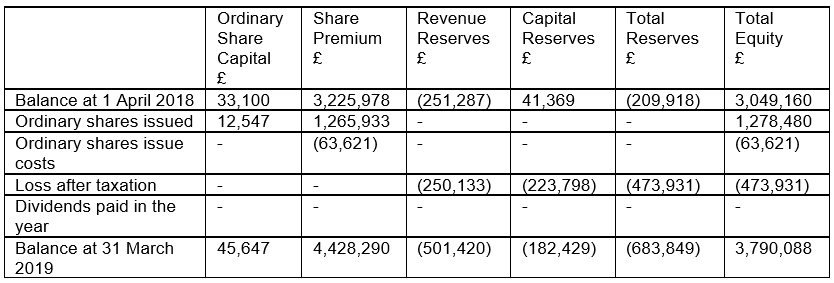

Statement of Changes in Equity

For the year ended 31 March 2019

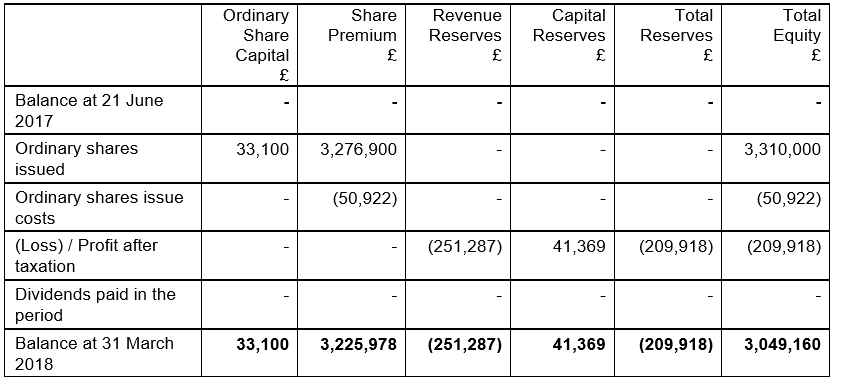

For the period from 21 June 2017 (date of incorporation) to 31 March 2018

As at 31 March 2019 the Company had distributable reserves of £nil (2018: £nil) for the payment of future dividends. The distributable reserves are the revenue reserves £nil (2018: £nil), realised capital reserves (£nil) (2018: (£nil)) and the special distributable reserves (£nil) (2018: (£nil)).

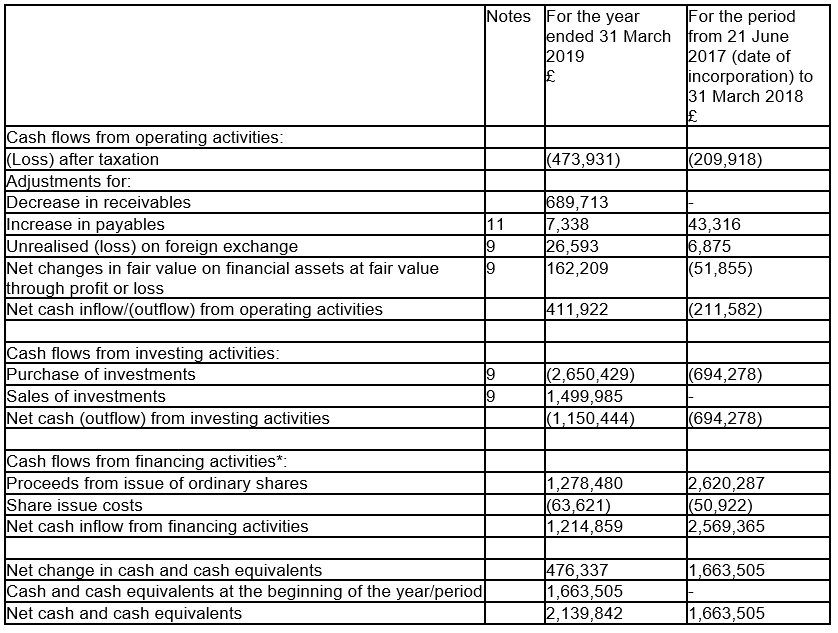

Statement of Cash Flows

For the year ended 31 March 2019

*The Company has no borrowings or liabilities from financing activities.

Notes to the Financial Statements:

1) Principal Accounting Policies

Basis of accounting

The financial statements of Sure Ventures plc (the “Company”) have been prepared in accordance with International Financial Reporting Standards (IFRS) and IFRIC interpretations (IFRS IC) as adopted by the European Union and the Companies Act 2006 applicable to companies reporting under IFRS.

The principal accounting policies adopted by the Company are set out below. Where presentational guidance set out in the Statement of Recommended Practice (‘SORP’) for investment trusts issued by the Association of Investment Companies (‘AIC’) in January 2017 is consistent with the requirements of IFRS, the directors have sought to prepare the financial statements on a basis compliant with the recommendations of the SORP.

All values are rounded to the nearest pound unless otherwise indicated.

Foreign Currency

The presentation currency of the Company is pounds sterling, the financial statements are prepared in this currency in accordance with the Company’s prospectus. The Company is required to nominate a functional currency, being the currency in which the Company predominantly operates. The board has determined that sterling is the Company’s functional currency.

Foreign exchange gains and losses relating to the financial assets and liabilities carried at fair value through profit or loss are presented in the statement of comprehensive income within ‘other net changes in fair value on financial assets and financial liabilities at fair value through profit or loss’.

Presentation of Statement of comprehensive income

In order to better to reflect the activities of an investment trust company and in accordance with guidance issued by the AIC, supplementary information which analyses the Statement of comprehensive income between items of a revenue and capital nature has been presented alongside the Statement of comprehensive income.

Income

Dividend income from investments is recognised when the Company’s right to receive payment has been established, normally the ex-dividend date.

Interest income in profit or loss in the Statement of Comprehensive Income includes bank interest. Interest income is recognised on an accruals basis.

Capital income, all changes in fair value are recognised in profit or loss in the Statement of Comprehensive Income as net gain on investment at fair value through profit or loss.

Expenses

All expenses are accounted for on the accruals basis. In respect of the analysis between revenue and capital items presented within the Statement of Comprehensive Income, all expenses have been presented as revenue items except as follows:

• Transaction costs which are incurred on the purchases or sales of investments designated as fair value through profit or loss are expensed to capital in the Statement of Comprehensive Income.

• Expenses are split and presented partly as capital items where a connection with the maintenance or enhancement of the value of the investments held can be demonstrated and, accordingly, the management fee for the financial year has been allocated 24.24% (2018: 24.24%) to revenue and 75.76% (2018: 75.76%) to capital (Investment held at fair value through profit or loss to the net asset value of the Company), in order to reflect the directors’ long term view of the nature of the expected investment returns of the Company.

Capital Reserves

Increases and decreases in the valuation of investments and realised/unrealised foreign exchange gain/(loss) held at the year end are accounted for in the capital reserves.

Taxation

In line with the recommendations of the SORP, the allocation method used to calculate tax relief on expenses presented against capital returns in the supplementary information in the Statement of comprehensive income is the ‘marginal basis’. Under this basis, if taxable income is capable of being entirely offset by expenses in the revenue column of the statement of comprehensive income, then no tax relief is transferred to the capital return column.

Deferred tax is the tax expected to be payable or recoverable on differences between the carrying amounts of assets and liabilities in the financial statements and the corresponding tax bases used in the computation of taxable profit and is accounted for using the Statement of Financial Position liability method. Deferred tax liabilities are recognised for all taxable temporary differences and deferred tax assets are recognised to the extent that it is probable that taxable profits will be available against which deductible temporary differences can be utilised.

Deferred tax is calculated at the tax rates that are expected to apply in the period when the liability is settled or the asset is realised. Deferred tax is charged or credited in the revenue return column of the Statement of comprehensive income, except when it relates to items charged or credited directly to equity, in which case the deferred tax is also dealt with in equity.

Investment trusts which have approval under Part 24, Chapter 4 of the Corporation Tax Act 2010 are not liable for taxation on capital gains.

Classification

Financial assets and financial liabilities

In accordance with IFRS, the Company has designated its investments as financial assets at fair value through profit or loss.

i) Financial assets at fair value through profit or loss

The Company has designated all of its investments upon initial recognition as “financial assets at fair value through profit or loss”. Their performance is evaluated on a fair value basis, in accordance with the risk management and investment strategies of the Fund, as set out in the Company’s supplement to the Prospectus.

ii) Financial assets at amortised cost

Financial assets that are classified as “financial assets at amortised cost” include cash and cash equivalents and receivables.

iii) Financial liabilities at fair value through profit or loss

Financial liabilities that are not at fair value through profit or loss include other payables.

Derecognition

Financial assets are derecognised when the rights to receive cash flows from the financial assets have expired or where the group has transferred substantially all risks and rewards of ownership. If substantially all the risks and rewards have been neither retained nor transferred and the group has retained control, the assets continue to be recognised to the extent of the group’s continuing involvement. Financial liabilities are derecognised when they are extinguished.

Investments

All investments held by the Company have been designated at fair value through profit or loss (‘FVPL’) but are also described in these financial statements as investments held at fair value, and are valued in accordance with the International Private Equity and Venture Capital Valuation Guidelines (‘IPEVCV’) issued in December 2018 as endorsed by the British Private Equity and Venture Capital Association.

Purchases and sales of unlisted investments are recognised when the contract for acquisition or sale becomes unconditional.

Receivables

Receivables do not carry any interest and are short term in nature. They are initially stated at their nominal value and reduced by appropriate allowances for estimated irrecoverable amounts (if any).

Cash and cash equivalents

Cash and cash equivalents (which are presented as a single class of asset on the Statement of Financial Position) comprise cash at bank and in hand and deposits with an original maturity of three months or less. The carrying value of these assets approximates their fair value.

Payables

Payables are non-interest bearing.

Dividends

Interim dividends are recognised in the year in which they are paid. Final dividends are recognised when they have been approved by shareholders.

New standards, amendments and interpretations effective from 1 January 2018

The following standards, amendments and interpretations, which became effective in January 2018, are relevant to the Company.

IFRS 9, ‘Financial instruments’

International Financial Reporting Standards 9 (“IFRS 9”) effective for annual periods beginning on or after 1 January 2018, specifies how an entity should classify and measure financial assets and liabilities, including some hybrid contracts.

IFRS 9 was issued by the International Accounting Standards Board (“IASB”) in July 2014 and replaced International Accounting Standards 39 Financial Instruments – Recognition and Measurement (“IAS 39”).

IFRS 9 improves and simplifies the approach for classification and measurement of financial assets compared with the requirements of IAS 39. Most of the requirements in IAS 39 for classification and measurement of financial liabilities were carried forward unchanged. IFRS 9 applies a consistent approach to classifying financial assets and replaces the numerous categories of financial assets in IAS 39, each of which had its own classification criteria.

The Company has applied IFRS 9, Financial instruments (“IFRS 9”) retrospectively but the application of IFRS 9 has not resulted in a restatement of comparative information. The Company has taken an exemption not to restate comparative information. IFRS 9 has resulted in changes to the classification of financial assets as disclosed in Note 9 (b) ; there has been no impact on the carrying values of financial instruments and the Company’s accounting policies related to liabilities and derivatives financial instruments that are not used as hedging instruments.

i) Classification and measurements of financial assets and financial liabilities

IFRS 9 largely retains the existing requirements in IAS 39 for the classification and measurement of financial liabilities. However, it eliminates the previous IAS 39 categories for financial assets of held to maturity, loans and receivables and available for sale.

Under IFRS 9, on initial recognition, a financial asset is classified as measured at: Fair value through profit or loss (FVTPL), Fair Value through other comprehensive income (FVOCI) and amortised cost.

The classification of financial assets under IFRS 9 is generally based on the business model in which a financial asset is managed and its contractual cash flow characteristics.

The Company has classified its financial assets at FVTPL and amortised cost.

Financial assets and liabilities at fair value through profit or loss

A financial asset and liabilities at FVTPL is initially measured at fair value. These assets and liabilities are subsequently measured at fair value. Net gains and losses, including any interest or dividend income, are recognised in profit or loss. On initial recognition, the Company may irrevocably designate a financial asset that otherwise meets the requirements to be measured at amortised cost as at FVTPL if doing so eliminates or significantly reduces an accounting mismatch that would otherwise arise.

A financial asset (unless it is a trade receivable without a significant financing component that is initially measured at the transaction price) is initially measured at fair value plus, for an item not at FVTPL, transaction costs that are directly attributable to its acquisition.

The financial assets and liabilities are subsequently measured at fair value. Net gains and losses, including any interest or dividend income, are recognised in profit or loss.

On initial recognition of an equity investment that is not held for trading, the Company may irrevocably elect to present subsequent changes in the investment’s fair value in OCI. This election is made on an investment-by-investment basis.

On subsequent measurement of financial assets;

· debt investments at FVOCI are measured at fair value. Interest income calculated using the effective interest method, foreign exchange gains and losses and impairment are recognised in profit or loss. Other net gains and losses are recognised in OCI. On derecognition, gains and losses accumulated in OCI are reclassified to profit or loss.

· equity investment at FVOCI are measured at fair value. Dividends are recognised as income in profit or loss unless the dividend clearly represents a recovery of part of the cost of the investment. Other net gains and losses are recognised in OCI and are never reclassified to profit or loss.

Financial assets held at amortised cost

A financial asset is measured at amortised cost if it meets both of the following conditions and is not designated as at FVTPL:

· it is held within a business model whose objective is to hold assets to collect contractual cash flows; and

· its contractual terms give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding.

These assets are subsequently measured at amortised cost using the effective interest method. The amortised cost is reduced by impairment losses. Interest income, foreign exchange gains and losses and impairment are recognised in profit or loss. Any gain or loss on derecognition is recognised in profit or loss.

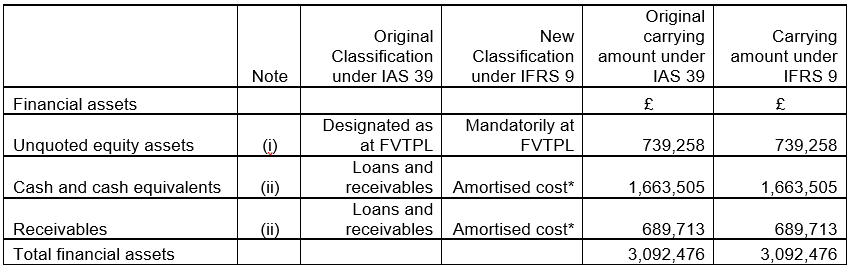

Measurement category under IAS 39 and IFRS 9

The following table and the accompanying notes below explain the original measurement categories under IAS 39 and the new measurement categories under IFRS 9 for each class of the Company’s financial assets as at 1 January 2018.

* No impairment was recognised on the amortised cost classification on the original carrying amount value under IFRS 9 on transition.

The classification of financial liabilities has not changed under the transition from IAS 39 to IFRS 9.

(i) Under IAS 39, these Unquoted equity assets were designated as at FVTPL because they were managed on a fair value basis and their performance was monitored on this basis. These assets have been classified as mandatorily measured at FVTPL under IFRS 9.

(ii) Cash and cash equivalents and receivables, that were classified as loans and receivables under IAS 39 are now classified at amortised cost.

(ii) Impairment of financial assets

IFRS 9 replaces the ‘incurred loss’ model in IAS 39 with an ‘expected credit loss’ (ECL) model. The new impairment model applies to financial assets the Company has measured at amortised cost. Under IFRS 9, credit losses are recognised earlier than under IAS 39.

The financial assets at amortised cost consist of cash and cash equivalents.

Under IFRS 9, loss allowances are measured on either of the following bases:

· 12-month ECLs: these are ECLs that result from possible default events within the 12 months after the reporting date; and

· lifetime ECLs: these are ECLs that result from all possible default events over the expected life of a financial instrument

The Company measures loss allowances at an amount equal to lifetime ECLs, except for the following, which are measured as 12-month ECLs:

· debt securities that are determined to have low credit risk at the reporting date; and

· other debt securities and bank balances for which credit risk (i.e. the risk of default occurring over the expected life of the financial instrument) has not increased significantly since initial recognition.

When determining whether the credit risk of a financial asset has increased significantly since initial recognition and when estimating ECLs, the Company considers reasonable and supportable information that is relevant and available without undue cost or effort. This includes both quantitative and qualitative information and analysis, based on the Company’s historical experience and informed credit assessment and including forward-looking information.

The maximum period considered when estimating ECLs is the maximum contractual period over which the Company is exposed to credit risk.

Measurement of ECLs

ECLs are a probability-weighted estimate of credit losses. Credit losses are measured as the present value of all cash shortfalls (i.e. the difference between the cash flows due to the entity in accordance with the contract and the cash flows that the Company expects to receive).

ECLs are discounted at the effective interest rate of the financial asset.

Credit-impaired financial assets

At each reporting date, the Company assesses whether financial assets carried at amortised cost are credit-impaired. A financial asset is ‘credit-impaired’ when one or more events that have a detrimental impact on the estimated future cash flows of the financial asset have occurred.

Presentation of impairment

Loss allowances for financial assets measured at amortised cost are deducted from the gross carrying amount of the assets.

Impairment losses on other financial assets are presented under ‘finance costs’, similar to the presentation under IAS 39, and not presented separately in the statement of profit or loss and OCI due to materiality considerations.

iii) Transition

Changes in accounting policies resulting from the adoption of IFRS 9 have been applied retrospectively, except as described below.

· The Company has taken an exemption not to restate comparative information for prior periods with respect to classification and measurement (including impairment) requirements.

· The following assessments have been made on the basis of the facts and circumstances that existed at the date of initial application.

o The determination of the business model within which a financial asset is held.

o The designation and revocation of previous designations of certain financial assets and financial liabilities as measured at FVTPL.

· If an investment in a debt security had low credit risk at the date of initial application of IFRS 9, then the Company has assumed that the credit risk on the asset had not increased significantly since its initial recognition.

IFRS 15 Revenue from Contracts with Customers

IFRS 15, ‘Revenue from contracts with customers’ deals with revenue recognition and establishes principles for reporting useful information to users of financial statements about the nature, amount, timing and uncertainty of revenue and cash flows arising from an entity’s contracts with customers. It is effective from 1 January 2018. Revenue is recognised when a customer obtains control of a good or service and thus has the ability to direct the use and obtain the benefits from the good or service. The standard replaces IAS 18, ‘Revenue’ and IAS 11, ‘Construction contracts’ and related interpretations Management have considered the impact of IFRS 15 on the provision of services and management income that fall under the scope of IFRS 15 and has had no impact on the Company in the financial period as there is no revenue to be recognised but may do so in the future.

There are no other standards, amendments to standards or interpretations that are effective for annual periods beginning on 1 January 2018 that have a material effect on the financial statements of the Company.

Adoption of New and Revised Standards

The International Accounting Standards Board has issued the following standards, which may be relevant to the Company’s reporting but which have not yet been applied and have an effective date after the date of these financial statements:

New Standards, Amendments and Interpretations

Standards, amendments and interpretations to existing standards that become effective in future accounting periods and have not been adopted by the Company are as follows:

IFRS Effective for annual periods beginning on or after

IFRS 16 – Leases 1 January 2019

IFRS 16 Leases

The directors do not anticipate that the adoption of this standard and interpretations will have a material impact on the financial statements in the period of initial application.

Other future developments include the International Accounting Standards Board (‘IASB’) undertaking a comprehensive review of existing IFRSs. The Company will consider the financial impact of these new standards as they are finalised.

CAPITAL STRUCTURE

Share Capital

Ordinary shares are classed as equity. The ordinary shares in issue have a nominal value of one penny and carry one vote each.

Share Premium

This reserve represents the difference between the issue price of shares and the nominal value of shares at the date of issue, net of related issue costs.

Capital Reserve

Unrealised gains and losses on investments held at the year end arising from movements in fair value are taken to the capital reserve.

Revenue Reserve

Net revenue profits and losses of the Company.

2) SIGNIFICANT ACCOUNTING JUDGEMENTS, ESTIMATES AND ASSUMPTIONS

The preparation of financial statements in conformity with IFRS as adopted in the EU requires the Company to make judgements, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting year. Although these estimates are based on the directors’ best knowledge of the amount, actual results may differ ultimately from those estimates.

The areas requiring a higher degree of judgement or complexity and areas where assumptions and estimates are significant to the financial statements are in relation to investments at fair value through profit or loss described below.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimates are revised and in any future periods affected.

Equity Investments

The unquoted equity assets are valued on periodic basis using techniques including a market approach, costs approach and/or income approach. The valuation process is collaborative, involving the finance and investment functions within the manager with the final valuations being reviewed by the manager’s valuation committee.

Shareholders should note that increases or decreases in any of the inputs in isolation may result in higher or lower fair value measurements. Changes in fair value of all investments held at fair value are recognised in the Statement of comprehensive income as a capital item. On disposal, realised gains and losses are also recognised in the Statement of comprehensive income. IFRS 9 was adopted but did not have a material impact on the Company.

3) SEGMENTAL REPORTING

The Company’s board and the Investment Manager consider investment activity in selected Equity Assets as the single operating segment of the Company, being the sole purpose for its existence. No other activities are performed.

The directors are of the opinion that the Company is engaged in a single segment of business and operations of the Company are wholly in the United Kingdom.

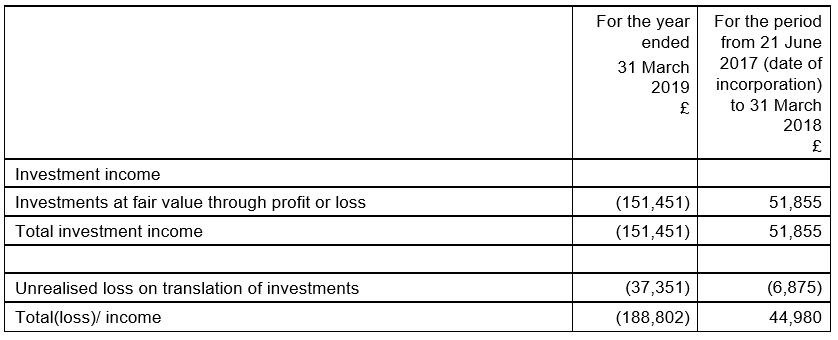

4) INCOME

5) MANAGEMENT AND PERFORMANCE FEE

Management Fee

The management fee is payable quarterly in advance at a rate equal to 1/4 of 1.25% per month of net asset value (the ”Management Fee”). The aggregate fee payable on this basis must not exceed 1.25% of the net assets of the Company in any year.

From the period from first admission, the management fee payable was based on 1.25% of the net asset value.

Performance Fee

The Manager is entitled to a performance fee, which is calculated in respect of each twelve month period starting on 1 April and ending on 31 March in each calendar year (‘Calculation Period’), and the final Calculation Period shall end on the day on which the management agreement is terminated or, if earlier, the business day immediately preceding the day on which the Company goes into liquidation.

The Manager is entitled to receive a performance fee equal to 15% of any excess returns over a high watermark, subject to achieving a hurdle rate of 8% in respect of each performance period. There was no performance fee payable during the period.

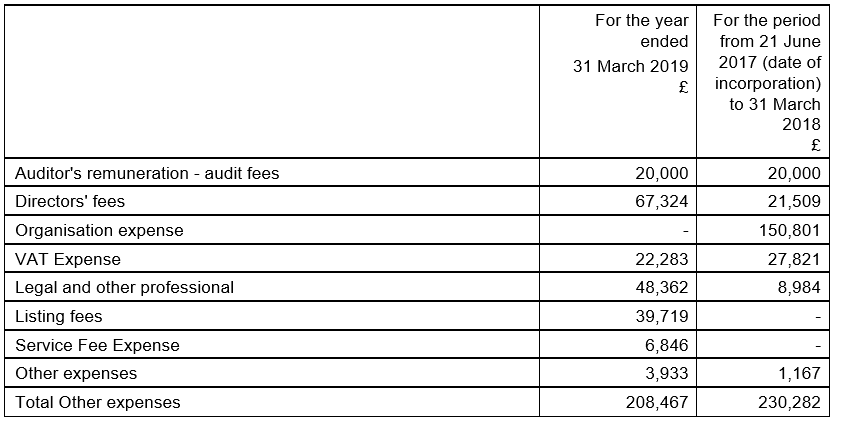

6) OTHER EXPENSES

All expenses are inclusive of VAT where applicable. Further details on directors’ fees can be found in the directors’ remuneration report on page 33.

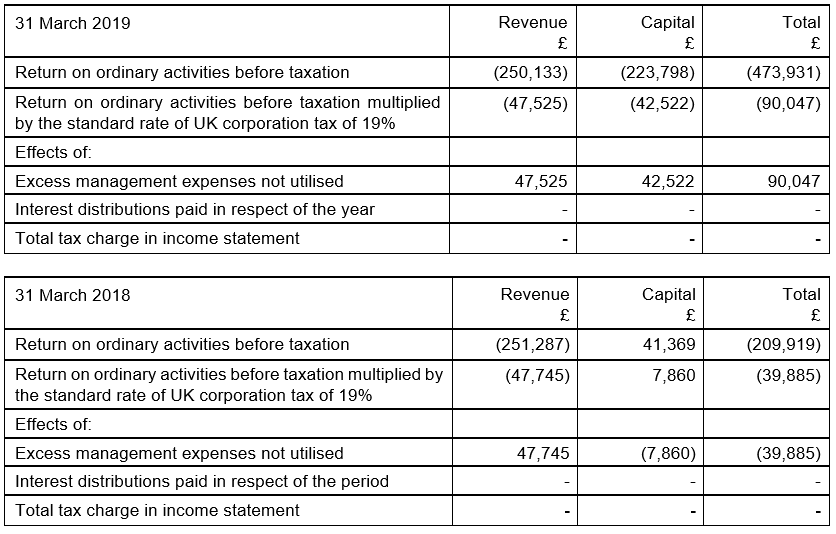

7) TAXATION

As an investment trust the Company is exempt from corporation tax on capital gains. The Company’s revenue income is subject to tax, but offset by any interest distribution paid, which has the effect of reducing that corporation tax to nil (2018: nil). This means the interest distribution may be taxable in the hands of the Company’s shareholders.

Any change in the Company’s tax status or in taxation legislation generally could affect the value of investments held by the Company, affect the Company’s ability to provide returns to shareholders, lead the Company to lose its exemption from UK Corporation tax on chargeable gains or alter the post-tax returns to shareholders. It is not possible to guarantee that the Company will remain a non-close company, which is a requirement to maintain status as an investment trust, as the ordinary shares are freely transferable. The Company, in the event that it becomes aware that it is a close company, or otherwise fails to meet the criteria for maintaining investment trust status, will as soon as reasonably practicable, notify shareholders of this fact.

The Company has obtained this approval from HM Revenue & Customs.

Factors affecting taxation charge for the year

The taxation charge for the year is lower than the standard rate of UK corporation tax of 19.00% (2018: 19.00%). A reconciliation of the taxation charge based on the standard rate of UK corporation tax to the actual taxation charge is shown below.

Overseas taxation

The Company may be subject to taxation under the tax rules of the jurisdictions in which it invests, including by way of withholding of tax from interest and other income receipts. Although the Company will endeavour to minimise any such taxes this may affect the level of returns to shareholders.

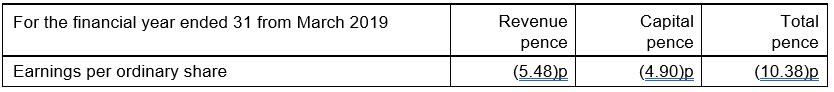

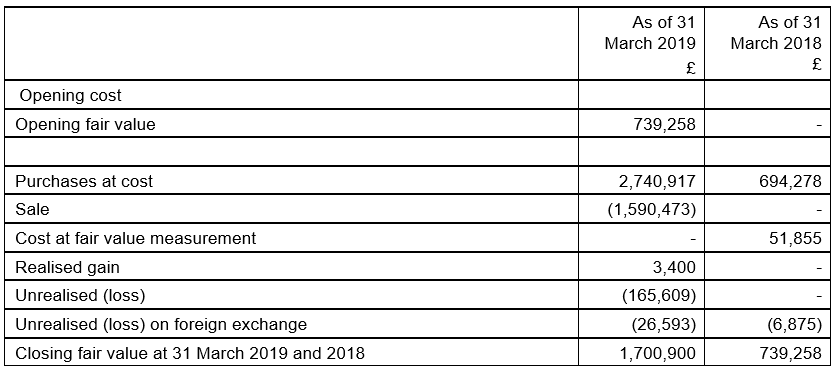

8) EARNINGS PER SHARE

The calculation of the above is based on revenue returns of (£250,133), capital returns of (£223,798) and total returns of (£473,931) and number of ordinary shares of 4,564,748 as at 31 March 2019.

The calculation of the above is based on revenue returns of (£251,287) capital returns of £41,369 and total returns of (£209,919) and number of ordinary shares of 3,310,000 as at 31 March 2018.

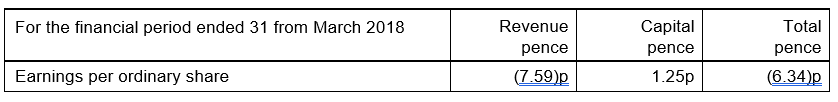

9) INVESTMENTS AT FAIR VALUE THROUGH PROFIT OR LOSS

(a) Movements in the year

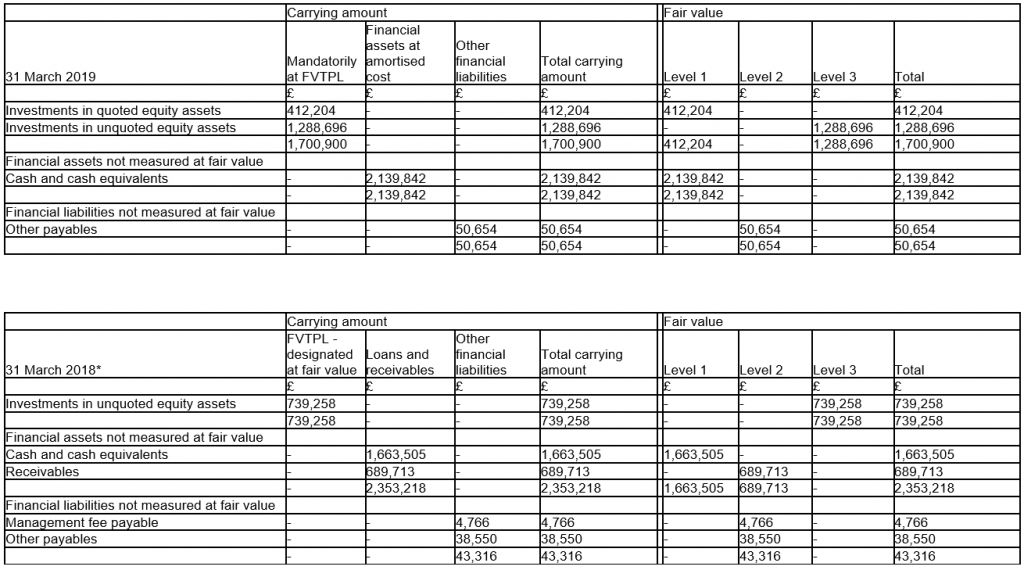

(b) Accounting classifications and fair values

IFRS 13 requires the Company to classify its financial instruments held at fair value using a hierarchy that reflects the significance of the inputs used in the valuation methodologies. These are as follows:

Level 1 – quoted prices in active markets for identical investments;

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayments, credit risk, etc.); and

Level 3 – significant unobservable inputs (including the Company’s own assumptions in determining the fair value of investments).

The following sets out the classifications used as at 31 March 2019 in valuing the Company’s investments:

* The Company has initially applied IFRS 9 at 1 January 2018. Under the transition methods chosen, comparative information is not restated.

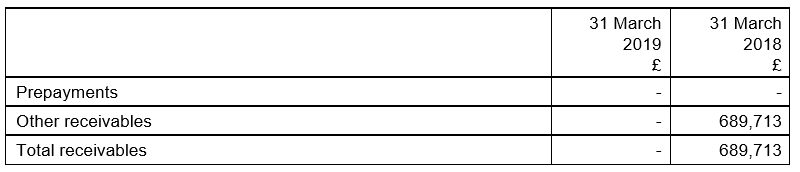

10) RECEIVABLES

The above receivables do not carry any interest and are short term in nature. The directors consider that the carrying values of these receivables approximate their fair value.

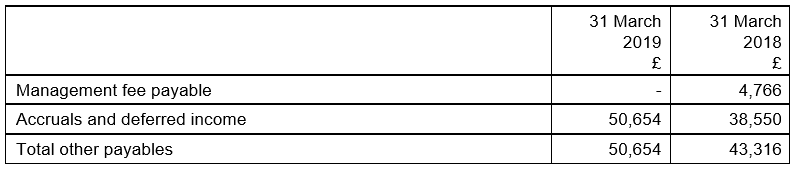

11) OTHER PAYABLES

The above payables do not carry any interest and are short term in nature. The directors consider that the carrying values of these payables approximate their fair value.

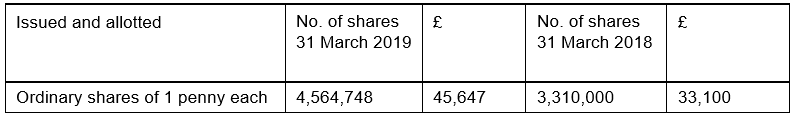

12) ORDINARY SHARE CAPITAL

The table below details the issued share capital of the Company as at the date of the Financial Statements.

On incorporation, the issued share capital of the Company was £0.01 represented by one ordinary share of £0.01. Redeemable preference shares of 50,000 were also issued with a nominal value of £1 each, of which 25% was paid. The redeemable shares were issued to enable the Company to obtain a certificate of entitlement to conduct business and to borrow under section 761 of the Companies Act 2006. The redeemable shares were redeemed on listing from the proceeds of the issue of the new ordinary shares upon admission on 19 January 2018.

The following table details the subscription activity for the year ended 31 March 2019.

During the year ended 31 March 2019, all proceeds from this issue was received (2018: £689,713 remained receivable).

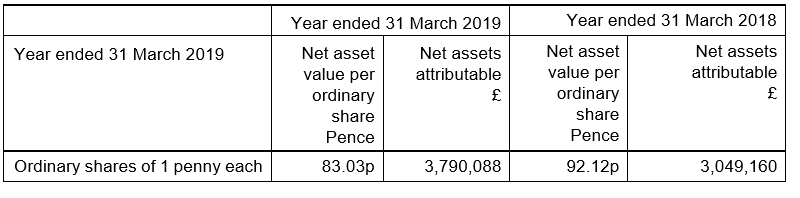

13) NET ASSET VALUE PER ORDINARY SHARE

The net asset value per ordinary share is based on net assets at the year ended of £3,790,088 (2018: £3,049,160) and on 4,564,748 (2018: 3,310,000) ordinary shares in issue at the year end.

14) CONTINGENT LIABILITIES AND CAPITAL COMMITMENTS

The Company may invest in Suir Valley Ventures or other collective investment vehicles, subscriptions to which are made on a commitment basis. The Company will be expected to make a commitment that may be drawn down, or called, from time to time at the discretion of the manager of the Fund or other collective investment vehicle. The Company will usually be contractually obliged to make such capital call payments and a failure to do so would usually result in the Company being treated as a defaulting investor by the Fund or other collective investment vehicle.

The Company’s has to satisfy capital calls on its commitments and will do through a combination of reserves, and where applicable the realisation, of Cash and Cash Equivalents and Liquid Investments (as each expression is defined in the prospectus dated 17 November 2017), anticipated future cash flows to the Company, the use of borrowings and, potentially, further issues of Shares.

As of 31 March 2019, the Company had outstanding commitments in relation to the Fund in the amount of €2.9 million (2018: €3,8 million).

15) RELATED PARTY TRANSACTIONS AND TRANSACTIONS WITH THE MANAGER

Directors – The remuneration of the directors is set out in the directors’ Remuneration Report on page 34. There were no contracts subsisting during or at the end of the year in which a director of the Company is or was interested and which are or were significant in relation to the Company’s business. There were no other transactions during the year with the directors of the Company. The directors do not hold any ordinary shares of the Company.

At 31 March 2019, there was £1,192 (2018: £203) payable to the directors for fees and expenses.

Manager – Shard Capital AIFM LLP (the ‘Manager’), a UK-based company authorised and regulated by the Financial Conduct Authority, has been appointed the Company’s manager and authorised investment fund manager for the purposes of the Alternative Investment Fund Managers Directive. Details of the services provided by the manager and the fees paid are given in Note 5.

During the year the Company incurred £46,193 (2018: £4,767) of fees and at 31 March 2018, there was £nil (2018: £4,767) payable to the Manager.

During the year the Company paid £63,621 (2018: £50,922) of placement fees to Shard Capital Partners LLP.

During the year the Manager paid £nil (2018: £12,000) to the advisor in relation to the flotation.

16) FINANCIAL RISK MANAGEMENT

The Company’s investment objective is to achieve capital growth for investors pursuant to the investment policy outlined in the prospectus, this involves certain inherent risks. The main financial risks arising from the Company’s financial instruments are market risk, credit risk and liquidity risk. The board reviews and agrees policies for managing each of these risks as summarised below.

Market risk

Market risk is the risk that the fair value of future cash flows of a financial instrument will fluctuate. Market risk comprises three types of risk, price risk, interest rate risk and currency risk.

Price risk – the risk that the fair value or future cash flows of financial instruments will fluctuate because of changes in market prices (other than those arising from interest rate risk or currency risk);

Interest rate risk – the risk that the fair value or future cash flows of financial instruments will fluctuate because of changes in market interest rates; and

Currency risk – the risk that the fair value or future cash flows of financial instruments will fluctuate because of changes in foreign exchange rates.

The Company’s exposure, sensitivity to and management of each of these risks is described below. Management of market risk is fundamental to the Company’s investment objective. The investment portfolio is continually monitored to ensure an appropriate balance of risk and reward within the parameters of the investment restrictions outlined in the prospectus.

(a) Price risk

Price risk arises mainly from uncertainty about future prices of financial instruments used in the Company’s business. It represents the potential loss the Company might suffer through holding market positions in the face of price movements (other than those arising from interest rate risk or currency risk) specifically in equity investments purchased in pursuit of the Company’s investment objective, held at fair value through the profit and loss.

As at 31 March 2019 and 2018 the Company held one direct private equity investment in the participating shares of Suir Valley Ventures, a sub-fund of Suir Valley Funds ICAV.

As at 31 March 2019 and 2018 the investment in Suir Valley Ventures is valued at the net asset value of the sub-fund, as calculated by its administrator.

At 31 March 2019, had the fair value of investments strengthened by 10% with all other variables held constant, net assets attributable to holders of participating shares would have increased by £170,090 (2018: £73,925). A 10% weakening of the market value of investments against the above would have resulted in an equal but opposite effect on the above financial statement amounts to the amounts shown above, on the basis that all other variables remain constant. Actual trading results may differ from this sensitivity analysis and the difference may be material.

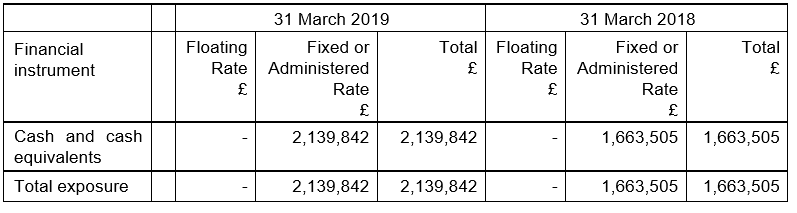

(b) Interest rate risk

Interest rate risk arises from the possibility that changes in interest rates will affect future cash flows or the fair values of financial instruments.

The Company’s currently employs no borrowings.

The Company finances its operations mainly through its share capital and reserves, including realised gains on investments.

Exposure of the Company’s financial assets and liabilities to floating interest rates (giving cash flow interest rate risk when rates are reset) and fixed interest rates (giving fair value risk) as at 31 March 2019 and 31 March 2018 is shown below:

An administered rate is not like a floating rate, movements in which are directly linked to LIBOR. The administered rate can be changed at the discretion of the lender.

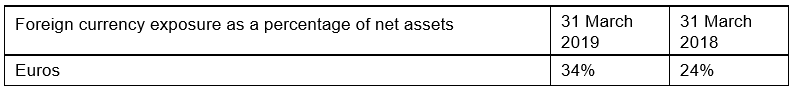

(c) Currency risk

As at 31st March 2019 the Company’s largest investment is denominated in euros whereas its functional and presentation currency is pounds sterling. Consequently, the Company is exposed to risks that the exchange rate of its currency relative to euros may change in a manner that has an adverse effect on the fair value of the Company’s assets.

At the reporting date the carrying value of the Company’s financial assets and liabilities held in individual foreign currencies as a percentage of its net assets were as follows:

Sensitivity analysis

If the euro exchange rates increased/decreased by 10% against pounds sterling, with all other variables held constant, the increase/decrease in the net asset attributable to the Company arising from a change financial assets at fair value through profit or loss, which are denominated in euros, would have been +/- £128,870 (2018: £73,925).

17) CREDIT RISK

Credit risk is the risk that one party to a financial instrument will cause a financial loss for the other party by failing to discharge an obligation.

The Company’s credit risks arise principally through cash deposited with banks, which is subject to risk of bank default.

The Company ensures that it only makes deposits with institutions with appropriate financial standing.

Due to the low credit risk of the financial assets at amortised cost, the ECL was determined to be immaterial and no impairment was recognised on the Fund in the period ended 31 March 2019.

Liquidity risk

Liquidity risk is the risk that the Company will have difficulty in meeting its obligations in respect of financial liabilities as they fall due.

The Company manages its liquid resources to ensure sufficient cash is available to meet its expected contractual commitments. It monitors the level of short-term funding and balances the need for access to short-term funding, with the long-term funding needs of the Company.

Capital Management

The Company’s capital is represented by ordinary shares and reserves.

The Company’s primary objectives in relation to the management of capital are:

· to maximise the long-term capital growth for its shareholders pursuant to its investment objective;

· to ensure its ability to continue as a going concern.

The Company manages its capital structure and liquidity resources to meet its obligations as described above.

Borrowing limits

Pursuant to the prospectus dated 17 November 2017 the Company can deploy gearing up to 20% of the net asset value of the Company (calculated at the time of borrowing) to seek to enhance returns and for the purpose of capital flexibility and efficient portfolio management. During the year ended 31st March 2019 and period ended 31st March 2018 the Company employed no gearing.

18) ULTIMATE CONTROLLING PARTY

It is the opinion of the directors that there is no ultimate controlling party.

19) EVENTS AFTER THE REPORTING PERIOD

On 26 April 2019 Sure Ventures PLC announced a direct investment of £500,000 in VividQ Limited, a UK-based deep tech software company pioneering the application of holography in AR/VR and consumer electronics display.

On 4 June 2019 Suir Valley, a sub-Fund of Suir Valley Funds ICAV, of which Sure Ventures PLC has committed EUR 4.5m, changed its name to Sure Valley Ventures.

On 7 June 2019 Sure Ventures PLC issued an additional 305,208 ordinary shares at a price of £0.96 per share, taking the total shares in issue to 4,869,956.

On 14 June 2019 Chris Boody resigned as a Non-Executive Director and St. John Agnew was appointed as a Non-Executive Director.

ENDS

For further information, please visit www.sureventuresplc.com or contact:

| Gareth Burchell | Sure Ventures plc | +44 (0) 20 7186 9918 |

| Melissa Hancock/ Gaby Jenner | St Brides Partners (Financial PR) | +44 (0) 20 7236 1177 |

Notes to Editors

Sure Ventures plc listed on the London Stock Exchange in January 2018 giving retail investors access to an asset class that is usually dominated by private venture capital funds. The Company aims to provide investors with a diversified exposure to three rapidly-growing markets: augmented reality/virtual reality, Artificial Intelligence and Internet of Things. Sure Ventures is focusing on companies in the UK, Republic of Ireland and other European countries, making seed and series A investments in companies with first rate management teams, products which benefit from market validation with target revenue run rates of at least £400,000 over the next 12 months.

Website: https://www.sureventuresplc.com/